What is a POS?

A point of sale (POS) system is responsible for processing sales transactions and allows businesses to accept payment methods like credit cards, cash, and contactless payments. Additionally, with the help of a barcode scanner, sales staff can scan products, eliminating the need for manual input. The system also generates digital receipts.

POS systems offer a range of features and capabilities to enhance business operations. They can track sales and inventory, manage customer profiles, and run loyalty programs.

With powerful reporting features, business owners can gain insights into their sales performance, cash flow, and inventory management.

POS systems are valuable to both retail businesses and the hospitality industry. They provide efficient and reliable solutions for day-to-day operations, improve customer service, and enable seamless interaction between customers, staff, and the business.

What are the benefits of using a POS system?

POS systems are multi-functional and, in the case of top-of-the-range systems, can be customised to suit the exact needs of your business. Below we discuss some of the most important benefits.

1. Automate the transaction process

- POS systems streamline the entire transaction process, from scanning products to accepting payment, reducing human errors and saving time.

- They automatically calculate totals and generate accurate receipts that can be printed or emailed.

2. Track sales data

- POS systems record and track sales data in real time, providing valuable insights into daily, weekly, and monthly sales patterns.

- Business owners can analyse this data to identify popular products, peak hours, and customer preferences, optimising their marketing and sales strategies.

3. Show sales patterns

- Easily view sales patterns over a specific period making strategic decision-making a breeze.

- Identify slow-selling items, create targeted promotions, and adjust pricing to maximise sales and profitability.

4. Catch discrepancies

- Detect discrepancies in prices and cash flow, ensuring accurate financial records.

- Flags price variations and compare the total received to the sales total, minimising the risk of theft and errors.

5. Monitor inventory levels

- Integrating with order management software, a POS system helps track stock levels in real-time.

- Alerts management when items run low, enabling them to reorder promptly and avoid stockouts. Modern systems can also automatically place orders.

A POS system offers numerous benefits, including automating the transaction process, tracking sales data, analysing sales patterns, detecting discrepancies, and efficient inventory management. It empowers business owners to make informed decisions, optimise their operations, and provide better customer service.

Components of a POS system

A point of sale (POS) system comprises various hardware and software components essential for daily operations.

- On the software side, a POS system often includes features like inventory management, customer relationship management (CRM), and reporting capabilities. This software enables business owners to track sales, monitor inventory levels, and analyse sales patterns to ensure they always make data-based decisions.

Additionally, some POS systems offer integrations with accounting software, loyalty programs, and employee management tools, further enhancing business functions.

- The hardware components typically include a cash drawer, receipt printer, barcode scanner, POS terminal, a traditional cash register or a tablet-based system.

These components allow for the efficient scanning of products, acceptance of various payment methods, including credit cards and contactless payments, and generation of customer receipts.

1. Receipt printer

Receipt printers provide customers with a physical copy of their transaction receipts. This physical copy serves as proof of purchase and is important for various reasons.

Firstly, a receipt printer ensures that customers have a tangible transaction record. This is especially crucial for brick-and-mortar locations where customers may need to return or exchange products. With a transaction receipt, customers have the necessary evidence to support their claims or validate their purchases.

Moreover, receipt printers and POS software offer convenience and flexibility by providing the option to send receipts via email. This feature is particularly beneficial in today's digital world, where many people prefer electronic copies of their receipts for record-keeping or expense-tracking purposes. By offering both physical and email receipts, businesses can cater to the diverse preferences of their customers.

2. Cash drawer

A cash drawer securely stores cash and coins in businesses that accept cash payments. It facilitates cash transactions and gives business owners a secure and organised way of handling cash flow.

The cash drawer connects to the POS software, which enables it to open electronically. When a cash transaction is processed, the software calculates the change due, and the cash drawer automatically opens, allowing the cashier to dispense the correct amount of cash to the customer.

3. Card reader

Card readers are used by businesses to help process credit and debit card transactions. They should not be confused with online banking card readers, which are used by customers of online banks to help them verify online transactions that they have made.

Card readers are a simple yet sophisticated piece of technology. Designed to read and communicate information from credit cards, debit cards and mobile wallets, they operate at lightning speed, making them a merchant’s best friend!

How do card readers work?

Although it happens in a matter of seconds, card readers follow a logical five step process:

Step 1. Payment authentication - Card readers obtain the card information via the magnetic stripe, the card’s chip or by tapping a contactless payment on the card reading device. And more commonly, customers can also pay via QR codes or mobile wallets.

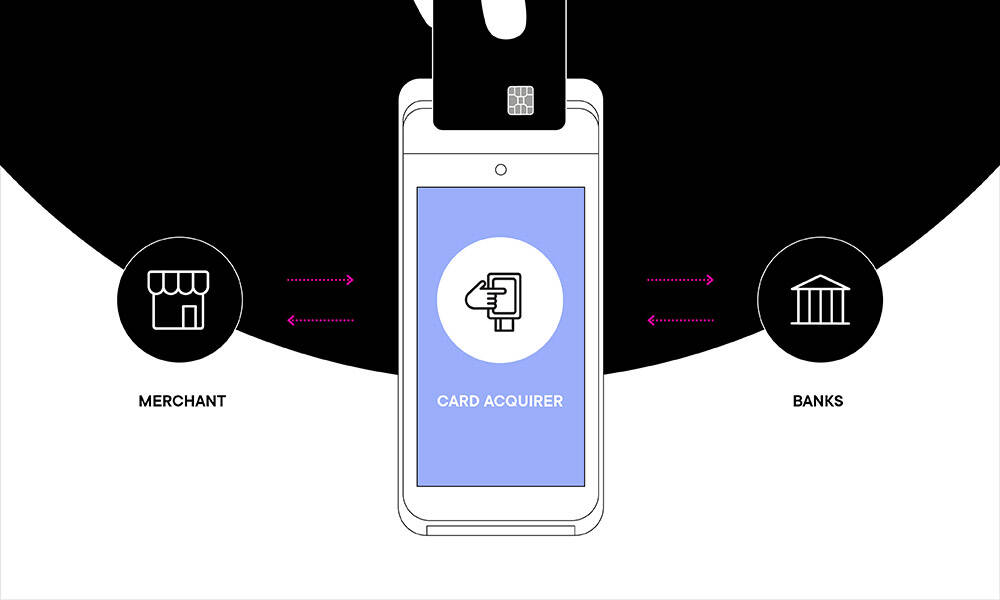

Step 2. Payment verification - The payment request is automatically sent to the merchant’s bank (also known as the acquirer), which forwards it to the payment processor.

Step 3. Payment authorisation - The payment processor takes the request and, using the card network sends it to the card issuer. The card issuer will check that the cardholder’s details are correct, confirm that the cardholder has sufficient funds in their account to pay for the transaction and then assess the fraud risk before deciding whether to approve or decline the transaction.

Step 4. Payment confirmation – The card issuer approves or declines the transaction, sending its response via the payment processor.

Step 5. Payment completion – If the transaction is approved, the funds are withdrawn from the cardholder’s account and transferred into the merchant’s account. This transfer can take up to three days, depending on the type of account held by the merchant.

Types of card readers

Businesses have a wide variety of card readers to choose from. What they have in common is the ability to help process credit and debit card transactions. How they differ is how they have been designed to be used. These are the most common types of credit and debit card readers:

- Countertop card readers – As the name suggests, countertop card readers are fixed to the business’s countertop. Most commonly found in the retail and hospitality industry, the customer must approach the countertop card readers to make the payment.

- Portable card readers – These are card readers designed to be used at a counter or elsewhere in the building. For that reason, they are popular with restaurants, which can take the portable card reader to the customer if they haven’t come to the counter to pay.

- Mobile card readers – Unlike portable card readers, mobile card readers are designed to be used on the move. The beauty about them is that they don’t limit the business to one location. For that reason, they are very popular with a wide range of users, including taxi drivers, delivery couriers, mobile caterers and market stalls. They process payments using GPRS technology and are connected to the Internet via a roaming SIM card.

- Virtual card readers – Virtual card readers are designed to turn the business’s computer into a payment card terminal. In doing so, they enable businesses to take credit and debit cards over the phone and process remote billing. Virtual card readers work by manually entering the cardholder’s data on a secure payment gateway. All you need for a virtual card reader to operate is a computer and an active internet connection.

- Point of sale apps - These apps have been created to help turn a business’s mobile phone into a payment terminal or card reader. What’s clever about point-of-sale apps is that they can operate without additional hardware. That’s because the app can read the cardholder’s information and then communicate it to the relevant parties in the payment acceptance process.

4. Barcode scanner

Barcode scanners offer numerous features and benefits that improve efficiency and aid in inventory management. Here are some key points to consider:

- Streamlined checkout process: Quickly scan barcodes on products, eliminating the need for manual entry, reducing human error and saving time for employees and customers.

- Accurate inventory management: Easily track and monitor stock levels by scanning barcodes during sales and restocking.

- Pricing accuracy: When a bar code is scanned, the system references the corresponding price eliminating pricing errors caused by manual entry and ensuring customers are charged the correct purchase amount.

- Data insights: Generate valuable data and analytics so management can identify popular products, optimal pricing strategies, and trends to improve operations.

- Integration capabilities: Integrations with other business tools, such as inventory management software, accounting software and analytics, enabling businesses to have almost unlimited functionality.

Types of POS terminals

1. Touch screen POS terminals

Touchscreen terminals serve as the interface between the business and the customer, facilitating the completion of transactions and providing essential functionality for businesses of all types.

These terminals can be mobile and stationary, running on various devices such as tablets or desktop computers. This versatility allows businesses to choose the type of POS terminal that best suits their needs and requirements.

Different types of hardware options are available:

- Tablets: These compact devices offer portability and are well-suited for businesses that require mobility, such as food trucks or pop-up stores. Tablets with touch screens can run POS software and connect to peripherals like receipt printers and barcode scanners.

- Desktop computers: These stationary terminals provide a robust and reliable platform for businesses with more extensive operations. They offer more processing power and storage capacity than tablets, making them suitable for high-volume or complex transactions.

- Smartphones: Some businesses utilise smartphones as POS terminals, especially those with limited space or on-the-go operations. With the help of mobile apps and specialised hardware attachments like card readers, smartphones can transform into efficient and cost-effective POS terminals.

2. Cloud-based POS

Cloud-based POS systems have changed the way businesses manage their point-of-sale operations. These systems utilise off-site servers to store and process data, eliminating the need for on-premises servers. Some of the main benefits of cloud-based POS systems include the following:

1. Always have the latest and safest software

With traditional systems, businesses are responsible for manually updating their software, which can be time-consuming and lead to lags in functionality. However, cloud-based systems automatically update with the latest features and security patches, ensuring that businesses always have access to the most up-to-date technology.

2. Easy to scale

With traditional systems, businesses often must invest in additional hardware and software licenses as they grow. However, cloud-based systems can quickly scale with the company, allowing seamless expansion without costly upgrades.

3. High-quality data

Business owners can monitor inventory levels and sales performance in real-time, enabling them to make informed decisions and stay ahead of demand. Additionally, cloud-based systems offer remote monitoring capabilities, allowing business owners to monitor their operations anywhere.

4. Mobile compatibility

Mobile devices, such as tablets and smartphones, can be used as POS terminals, providing flexibility and convenience to businesses, especially those with on-the-go operations.

5. Affordability

With no need for an initial investment in hardware or servers, businesses can get started with a cloud-based system at a fraction of the cost. These systems are constantly evolving, with new applications and features being released daily to enhance the functionality and efficiency of point-of-sale operations.

What POS system is best for my business?

Various POS systems are available in the market, each with features and capabilities tailored to specific industries or business needs.

A traditional cash register with built-in features like barcode scanners and receipt printers is commonly used for retail businesses. Businesses are increasingly adopting cloud-based POS systems. These modern systems offer multiple new features, such as inventory management, employee management, and customisable reporting.

In the hospitality industry, POS systems are specifically designed to cater to the needs of restaurants, cafes, and bars. These systems can handle complex order and table management and even integrate with kitchen display systems. POS systems for the hospitality industry are also equipped with features like tip management and mobile payment capabilities.

Moreover, specialised systems are available for specific business types like salons, boutiques, and food trucks. These systems offer industry-specific features, such as appointment scheduling for salons or inventory tracking for boutiques.

Choosing the right POS system for a business depends on its industry, size, and specific needs. Whether it is a traditional cash register or a cloud-based system with advanced features, investing in a reliable and efficient POS system can significantly benefit businesses in managing their day-to-day operations and improving overall efficiency.

1. Retail POS

Retail POS systems are indispensable tools for managing inventory, processing payments, and tracking sales in retail stores. Their integration of hardware components and functional software ensures a smooth and efficient customer checkout experience while providing valuable insights for overall business operations.

- Components: Cash register or POS terminal, barcode scanner, receipt printer, and cash drawer. Additionally, the system has software to enable functionality and process transactions.

- Functions: retail POS systems accurately calculate transaction totals, process various payment types, and generate digital or printed receipts for customers. These systems also manage inventory by tracking stock levels, updating product information, and generating reports.

- Inventory management: Track real-time inventory levels, allowing business owners to make informed decisions about purchasing and restocking. These systems can also generate reports that provide insights into fast-selling products, slow-moving inventory, and overall trends.

- Sales tracking: Sales transactions, detailed records of daily sales, sales by employee, and sales by product. This information helps monitor performance, identify popular products, and forecast future sales.

- Integrations: Integration capabilities with other business software like accounting, HR or customer relationship management (CRM) tools is essential to building a future-proof business.

2. POS for restaurants and bars

- Pre-authorisation for bar-tab management: One essential feature for restaurants and bars is pre-authorisation, which allows customers to open a tab and keep their credit card details securely associated with their orders. This ensures smooth tab management and fast checkout when it's time for customers to settle their bills.

- Bar and liquor inventory control: Restaurant and bar POS systems provide specialised features for managing bar and liquor inventory. These systems help track stock levels in real time, generate alerts for low inventory, and even integrate with liquor control systems to prevent theft and monitor pouring accuracy.

- Fast checkout: Quick service is crucial in restaurants and bars. POS systems enable fast checkout by allowing staff to easily split bills, process multiple payment methods, and apply discounts or promotions efficiently.

- 24/7 Support: Restaurants and bars operate long hours, and having reliable support is essential. Some POS providers offer 24/7 customer support, ensuring that any technical issues or questions can be promptly addressed, minimising downtime and maximising productivity.

- Employee and inventory management: Manage staff schedules, track time and attendance, and monitor sales performance. These systems also help with inventory management, restocking and preventing stockouts.

- Customer loyalty programs: Implement customer loyalty programs to incentivise repeat business. Loyalty programs can track guest spending habits, offer rewards or discounts, and provide valuable customer insights for effective marketing strategies.

- Recipes: POS systems can store and manage recipes, helping bartenders and kitchen staff ensure consistency and quality in the preparation of cocktails and dishes.

3. Hotels and resort POS

- Transfer of meal charges: Transfer meal charges from the dining room to guest rooms. This eliminates the need for guests to settle their bills at the restaurant and simplifies the payment process.

- Integration with a PMS (Property Management System): Enables department data-sharing ensuring accurate tracking of guest charges and simplifying billing and accounting processes.

- Room service management: Staff can take orders directly from the guest rooms and process payments instantly, ensuring quick and accurate service.

- Spa and wellness integrations: Enables guests to conveniently charge treatments and services to their rooms.

- Event and banquet management: Manage events and banquets by handling reservations, tracking orders, and generating accurate billing details for event organisers.

- Reporting and analytics: Detailed reporting and analytics capabilities enable managers to gain insights into sales trends, inventory management, and employee performance.

4. Grocery store POS

Inventory management enables store owners to quickly and accurately track stock levels, automate reordering processes, and prevent out-of-stock situations. This ensures customers can access the products they need and enables store owners to optimise their inventory to meet customer demand.

- Transaction processing: Equipped with barcode scanners and receipt printers, cashiers can scan items and process transactions quickly and accurately. With integrated card processing capabilities, customers can make payments using the payment method of their choice.

- Detailed reporting: Track and record every sale, providing detailed reports on sales trends, popular products, and peak operating hours. These insights enable store owners to optimise product placement, adjust pricing strategies, and enhance profitability.

- Profile management: Create and manage customer profiles, enabling retailers to personalise promotions, offer discounts, and implement loyalty programs. Smooth and efficient transactions contribute to positive customer experiences, ensuring satisfaction and loyalty.

- Secure transactions: By utilising secure payment processors, retailers can ensure customer payment information is encrypted and fraud-protected.

Final thoughts

Having the right POS system is essential for running an efficient, customer-centric business. Planet’s POS solutions go beyond simple transaction processing; they’re designed to enhance every aspect of your operations, from streamlined inventory management to integrated customer loyalty programs.

Whether you're in retail, hospitality, or any service industry, Planet’s POS systems offer the flexibility, scalability, and data-driven insights you need to make informed decisions and grow your business.

With our unique combination of payments and software solutions, you can manage your business seamlessly across multiple locations, currencies, and payment methods—all within a single platform.

Plus, our systems are designed with your industry in mind, offering features like real-time inventory tracking, integration with property management systems for hotels, and rapid transaction processing for high-demand environments.

Ready to elevate your POS experience and streamline your operations? Contact us today to learn how our tailored solutions can meet your business's unique needs and help you deliver an exceptional experience.