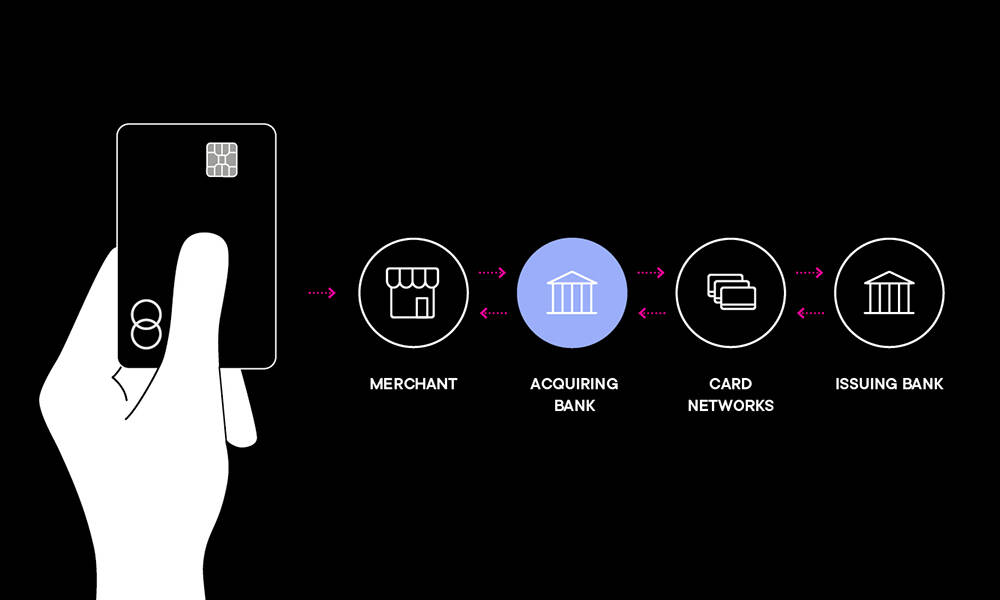

Card acquiring is just one step in the process of debit and credit card processing. However, it is crucial.

Below we will draw some comparisons to try and understand in more detail how all the different "roles" in a transaction function

What is a card acquirer?

A card acquirer is a financial institution that enables a merchant to accept card payments. It acts as the communication bridge between the merchant and the payment card provider, like Mastercard and Visa. The card acquirer makes the journey from processing card details to finalising the transaction possible.

Card acquiring is the process of collecting and transmitting debit and credit card details between participating parties to facilitate transactions. The card acquirer acts as the messenger enabling communication between banks and merchants and sending requests either way.

After a customer submits their payment card details, the acquirer initiates a request for payment authorisation. Based on the feedback from the customer’s bank, the acquirer communicates whether the transaction is successful or not. In case it isn’t, the acquirer tells the customer why.

Card acquirers are usually fintech companies, banks or other financial institutions. To conduct operations, they must be licensed by local and/or global payment regulators. They should also adhere to the rules of the payment networks, called card schemes, that issue the payment cards.

Difference between Card Acquirer and Acquiring Bank

These terms might sound quite alike, but they have distinct roles.

So, let's start with a "Card Acquirer". This is essentially the go-between that processes card transactions for businesses. When you swipe your card at your favorite coffee shop, it's the card acquirer that ensures the payment moves seamlessly from your bank account to the shop's bank account.

On the other side, we have the "Acquiring Bank". This is the financial institution that maintains the merchant's bank account. It's the bank where the money from your card transaction ultimately lands. When the coffee shop owner checks their bank balance at the end of the day, it's the acquiring bank that has facilitated that increase.

To put it simply, think of the card acquirer as the 'mail carrier' who moves the money, and the acquiring bank as the 'mailbox' that holds the money until the business is ready to use it. Both are necessary for the complete journey of your payment from your pocket to the merchant's.

What is an acquiring bank and why is it so important?

Difference between Card Acquirer and Card Issuer

Imagine you're back at the coffee shop we discussed above. When you use your card to pay, it's the card acquirer that takes charge. It’s the liaison that processes and settles the transaction, making sure the payment travels smoothly from your account to the coffee shop's account.

On the flip side, we have the "Card Issuer". This is the financial institution that provided you with your card in the first place, typically your bank. They manage your account, and when you buy that double shot of espresso, it's the card issuer's job to approve the transaction, subtract the money from your account, and send it on its way to the coffee shop.

The other roles in the card payment process

Various parties interact with each other to ensure successful offline and online payment execution. The most common ones include:

- Cardholder - the one making the payment request (usually the customer);

- Issuing bank - the bank that enables a customer to initiate card transactions;

- Merchant bank - an acquiring bank that enables a merchant service provider to process card transactions;

- Payment processor - the system connecting the customer’s bank to the merchant’s bank to facilitate debit or credit card payments;

- Card network (card scheme) - a global system that manages the transaction process for credit and debit cards (e.g., Visa or Mastercard).

Note that, although often mistaken, acquiring and issuing banks are different. The acquiring bank is the merchant’s bank that receives the money their customers have paid from the issuing bank.

Bear in mind that some acquiring banks (or acquirers) can also serve as payment processors. However, those that don’t partner with a third-party service provider. The role of the payment processor is usually purely technical - to facilitate and execute the transaction.

What happens during a transaction?

The exact transaction structure depends on the participating parties’ capabilities - for example, if the acquirer also serves as a payment processor.

However, in the general case, whether it is an in-person or online card transaction, the process looks the following way:

1. Initial request - it all starts when the customer provides their card details to the merchant. This happens through a payment processing service and device (e.g., a card reader/terminal or a digital wallet) connected to the card acquirer.

2. Card acquiring - the card acquirer receives the details and routes them through a payment gateway to the card network. The acquirer then ensures two-way communication between the card-issuing bank and the merchant’s bank. That way, the bank and the card provider (e.g., Mastercard or Visa) can verify whether they will charge the correct account for the transaction.

3. Transaction confirmation/decline - based on the received information, the issuing bank can authorise or decline the transaction. Possible reasons for the latter include lack of funds, suspected fraud, or failed authentication. In case the bank needs additional authentication to confirm the transaction, it asks the acquirer to request it from the customer. Once everything is fine, the bank approves the transaction, and the acquirer retrieves the funds.

4. Payment processing - the card acquirer communicates the outcome to the merchant. Then the funds are processed and deposited into the merchant’s account. This can happen either immediately or with a certain delay, depending on the card acquirer’s terms.

What is the link between card acquirers and card schemes like Visa and Mastercard?

Card acquirers and card organisations like Visa and Mastercard are integral parts of the same ecosystem. They work in tandem to facilitate credit and debit card transactions. However, they have different roles.

In the general case, an acquirer, usually a bank, gathers and separates payment details and communicates with the relevant card network to ensure that the card issuer, also a bank, will be able to approve the transaction. If successful, the issuing bank will transfer the funds to the merchant’s bank account.

Card schemes manage and control the overall transaction network. They set the standards for transaction processing, establish the rules and protocols for transactions, and determine the interchange fees for each transaction. They act as a bridge between the card-issuing banks and the card acquirers.

Card acquirers and card issuers must adhere to the official rules of card networks like Visa and Mastercard.

Furthermore, card schemes have imposed monitoring mechanisms to keep track of the acquirer’s performance in different areas. Some of the things they monitor include local and international chargebacks, returns, refunds and recurring transaction handling, securing payment credentials, digital certificate usage, and more.

How important are card acquirers for a merchant’s business?

Ask yourself this: How important do you find securing the payments that your business is owed? What about the ability to accept card payments at all?

While rhetorical, these questions help highlight the significance of the card acquirer’s role in a merchant’s business.

But not all acquirers are created equal. Figuring out the best one to partner with can greatly influence a business’s performance. Here are five key characteristics to consider to help you discover the best card acquirer for your needs:

1. Speed of funds transfer

Some card acquirers collect the funds and transfer them in bulk at a certain point - for example, at the end of every business day. The idea is to reduce the administration load on card payment systems.

However, there are card acquirers that will process transfers immediately - right after a transaction concludes. So, watch out for this if you want access to your funds as soon as they are retrieved from your customers.

2. Fee & pricing policy

For processing debit and credit card transactions, acquirers charge merchants a fee - a merchant discount rate (MDR). The fee is a percentage of the transaction amount, with the industry standard between 1% and 3%.

However, note that the MDR isn’t the only component of the total transaction costs. Other participants in the payment processing flow might add additional fees. For example, card networks and issuing banks may impose charge schemes and interchange fees. There might also be fees for authentication or payment solutions like terminals or gateways.

Based on the terms of the acquirer you use, the fees might all be included in the MDR. Most acquirers will disclose the fee structure’s specifics, informing you how much you are paying and to whom. However, this might not always be the case, so make sure to figure out the breakdown of the cost structure before choosing an acquirer.

3. Supported card payment methods

Most card acquirers support Visa and Mastercard debit and credit cards. However, keep in mind that not all support cards from niche networks like American Express or Diners Club.

Also, with the rise in popularity of digital wallets, you should ensure that your acquirer has you covered. While most customers still prefer to stick with well-known payment solutions like a plastic credit or debit card, for example, it doesn’t hurt to future-proof your business.

For example, you might want to find a card acquirer that offers integrations for Apple and Google Pay, Alipay, WeChat Pay, and other digital wallet solutions.

4. Reputation

Card acquiring is a complex process where multiple micro-operations between several parties take place all at once. It requires technical and operational expertise to handle a merchant’s transactions quickly, securely, and cost-efficiently.

To ensure they are served in the best possible way, merchants should be looking to partner with card acquirers with decades-long expertise. Not only have established service providers witnessed the niche’s evolution over time, but they have also been among its driving forces.

Last, but not least, make sure to find a card acquirer with a proven track record in professional and timely customer support. To do that, double-check what merchants similar to yours have to say about their customer service.

5. Value-added services

Beyond processing transactions, Planet empowers merchants with a comprehensive suite of value-added services designed to fuel business growth and streamline operations. Our integrated platform goes beyond basic card acquiring; it combines advanced payment gateways, single-terminal Point-of-Sale solutions, and multi-currency support to handle transactions with ease and precision—whether at the counter, online, or even internationally.

Planet’s extensive portfolio also includes flexible transaction processing, efficient international clearing, and settlement solutions that make global commerce simpler and more cost-effective. With built-in currency conversion and tax refund options, we enable merchants to provide a seamless experience for their international customers, making transactions smoother and reducing overhead.

When you partner with Planet, you’re choosing more than just a service provider. You’re partnering with an industry leader who understands the complexities of modern commerce across hospitality, retail, and beyond. We’re here to simplify your payments, consolidate your systems, and give you the tools to enhance your customer experience—all from a single, reliable platform.

Ready to elevate your business with Planet’s all-in-one solution? Contact us today to learn how our value-added services can streamline your operations and support your growth.

What is the future of card acquiring?

Market researchers are on the same page regarding the eCommerce market’s growth projections. According to Grandview Research, the CAGR will reach 14.7% by 2027, while Mordor Intelligence sees it topping 15.2%.

However, aside from expansion, the card payment market will also undergo a tectonic shift in its focus.

From the first payment card introduced in the late 1950s to today, commerce has gone through a remarkable evolution. However, the journey from cash-only to digital payments not only brought convenience but also the sense of losing the personal touch.

Payment service providers are now on a mission to bring that back. Commerce and eCommerce will continue to evolve, but it is in the hands of solution providers like card acquirers, banks, and card networks to ensure this evolution will be human-centred. The signs are that the ecosystem is moving in the right direction. Nowadays, we have phone or smartwatch payments and vocalised transaction details for visually-impaired people - to ensure that commerce is inclusive and unites us all.

Going forward, merchants will continue striving to provide personalised services and products. They will want to guarantee that their customers are served in the best possible way. Card acquirers will be the ones tasked with ensuring that. Transaction processing will become faster, more flexible and more convenient, but technology will no longer be in the spotlight. It will drive the process behind the scenes, while the human-to-human connection will become ever more critical.